‣

Avalara and Oracle do the heavy lifting

Improve rate accuracy and reduce delivery errors

Avalara verifies addresses with rooftop accuracy across more than 13,000 tax jurisdictions in the United States. This helps ensure tax rates are applied more accurately than relying on ZIP codes and decreases the chance of wrong delivery.

‣

Better assess tax obligations on domestic sales

Avalara's solution tracks your economic nexus tax liabilities in states where you're potentially obligated to collect. Detailed reports will alert you when you're about to trigger tax obligations in new states.

‣

Easily manage taxability rules across a vast product inventory

Avalara experts have deep knowledge of product taxability rules and regulations to help you apply the appropriate tax rates and assign tariff codes.

‣

Remove the manual drain of filing and remittance

When it’s time to file, offload sales and use tax preparation in the U.S. and Canada as well as reporting for VAT and GST for international markets.

‣

Apply the right tax for complex situations

Save time and improve accuracy by codifying and automating advanced transaction rules based on circumstances unique to your business.

‣

Let Oracle do the work of managing exemption certificates

Collect and apply certificates at the point of sale. Manage a secure, centralized document repository to access for future purchases, generate reports, and reference during audits.

‣

Offload complicated methods of determining multiple tax types

Avalara offers a single platform to help manage sales and use tax, excise tax, VAT, and GST.

‣

Reduce audit risk by validating your tax-exempt sales

Avalara helps ensure your tax-exempt customers are keeping their certificates up to date. When certificates expire or become invalid, the system provides an alert at the time of sale.

The products that power compliance in your systems

Avalara AvaTax

Get cloud-based sales and use tax determination with comprehensive, regularly updated tax rates pushed to your shopping cart or invoicing system, automatically.

Avalara Returns

Offload returns preparation, filing, and remittance across multiple jurisdictions for every filing cycle.

Avalara Exemption Certificate Management

Easily collect, verify, store, renew, and manage tax documents on demand, reducing risk of audit penalties.

Avalara for international sales

Assign tariff codes and manage VAT and GST registration, determination, and reporting, with regularly updated content for more than 190 countries.

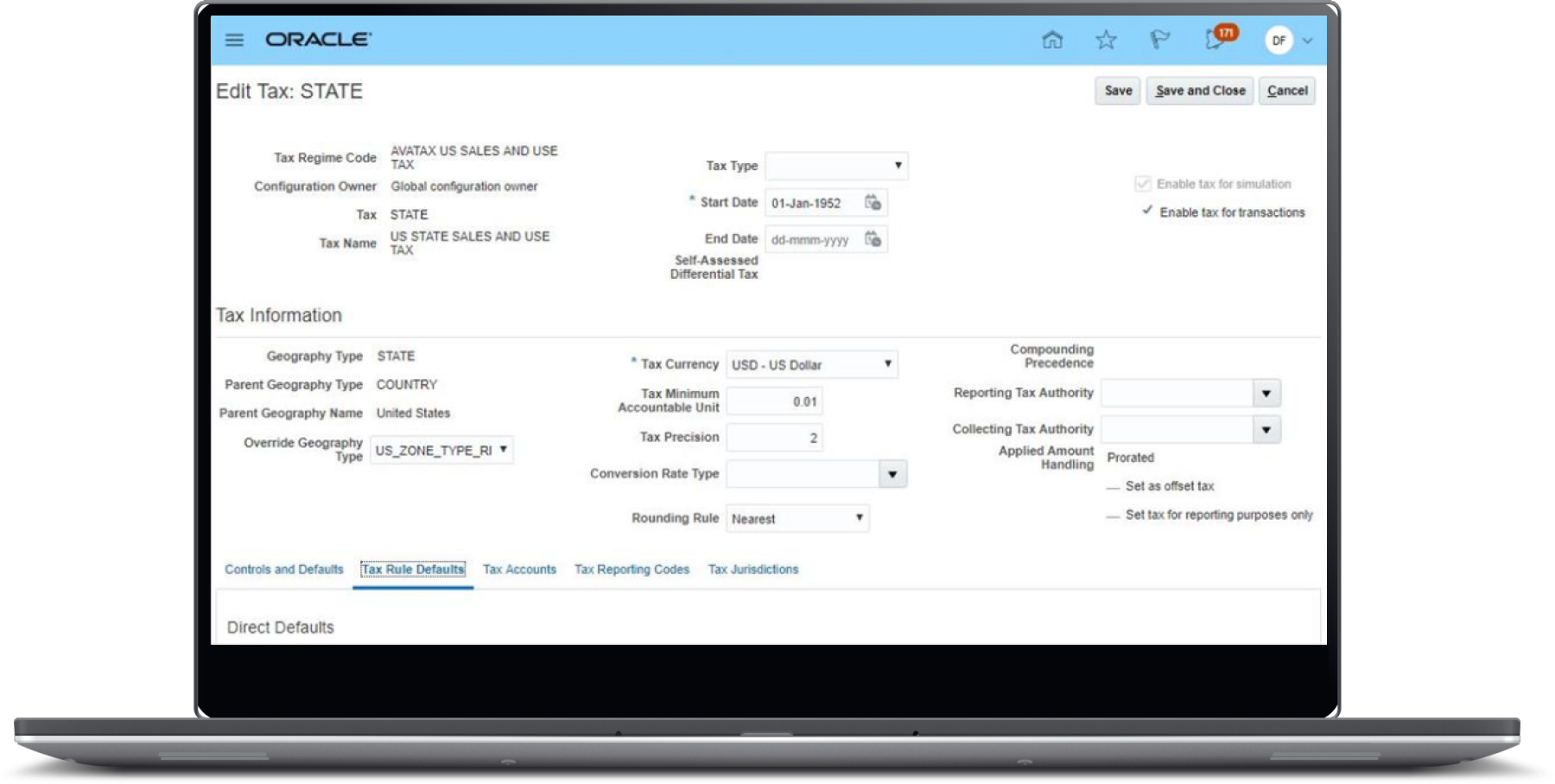

Watch how it works in Oracle (Fusion) ERP Cloud

Connect with Avalara

See how easily our solutions work with your business applications.

Curious how we help with your specific tax challenges? Just ask.

Get direct help with your most pressing questions about tax software.