Video: Learn how to get plain language answers to your tax research questions.

Avalara Tax Research

Sales tax research tools and services for comprehensive, easy-to-understand tax insights.

Schedule a call

What is Avalara Tax Research?

Intuitive, accessible sales and use tax research — when and where you need it

Quickly get updated transaction tax rules, rates, and regulations to help with tax decisions in both the U.S. and abroad.

Get the answers you need with tax research that’s easy to access and even easier to understand.

HOW DOES AVALARA TAX RESEARCH WORK?

Access the tax research you need in just a few easy steps:

Benefits of Avalara Tax Research

Self-service tax content research tools and services to help save time and maintain compliance

PICK THE ONE THAT’S RIGHT FOR YOU

Avalara Tax Research has 3 core products

for current sales and use tax content

Avalara Tax Research Essentials

Use a self-service research tool to help find the tax answers you need.

Avalara Tax Research Standard

Simplify your research solution with access to a Q&A database and dedicated tax researchers.Simplify your research solution with access to a Q&A database and dedicated tax researchers.

Avalara Tax Research Premium

Access all our features plus consolidated tax content in an easily exportable matrix.

|

Avalara Tax Research Essentials |

Avalara Tax Research Standard |

Avalara Tax Research Premium |

|

|---|---|---|---|

|

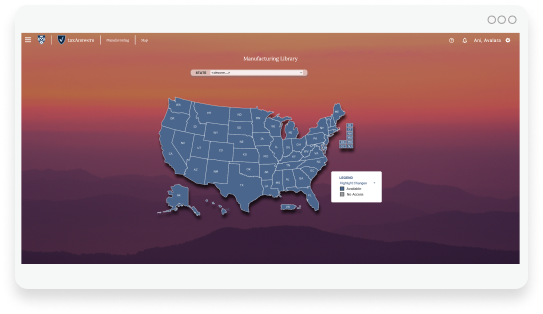

Coverage of all 50 states and D.C., and a map that details types of tax law changes |

|||

|

Customizable email notifications of tax updates and news |

|||

|

Audit defense support in case of inquiries |

|||

|

Advanced search engine with savable research and extensive filters |

|||

|

Comprehensive research of tax laws and documents you can share with your team |

|||

|

Database of sales and use tax rates by city, state, county, and ZIP code |

|||

|

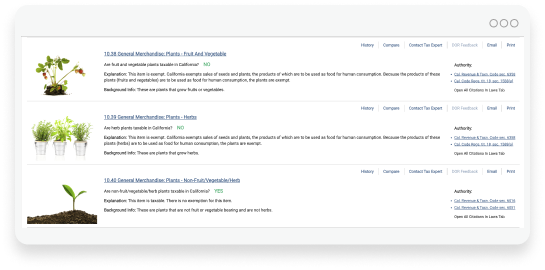

Simplified descriptions of what tax laws mean |

|||

|

Taxability charts per item across states that are easily shared with your team |

|||

|

Straightforward Yes/No answers to taxability questions |

|||

|

History of tax laws and answers to track changes |

|||

|

Decision trees for taxability in specific industries |

|||

|

Access to a Q&A database and tax researchers |

|||

|

Rooftop sales and use tax rates by address |

|||

|

Ability to create an automatically updated tax matrix for items or services and locations |

|||

|

Custom add-on library of products and services mapped to taxability and maintained by tax experts

Add-on is not included in base product price.

|

|||

|

Specialty industry add-ons for restaurant and telecommunications content

Add-on is not included in base product price.

|

|||

|

Global tax content add-ons to provide taxability information for companies operating internationally

Add-on is not included in base product price.

|

Tax research add-ons tailored to your industry and region

Stand-alone tax research solutions designed for your industry

Avalara Tax Research for Accountants

Find the research your accounting practice needs to help better serve clients.

Discover a complete suite of solutions to help accounting firms grow and improve profitability.

Frequently asked questions

What is Avalara Tax Research (formerly known as TTR Research)?

Tax Research is a family of self-service subscription-based products offered by Avalara following the acquisition of TTR. It provides sales tax content subscriptions and powerful research tools used by thousands of companies and tax professionals to help them get tax right.

What does TTR mean?

An Avalara company, TTR stands for Transaction Tax Resources.

When did Avalara acquire TTR?

Avalara acquired TTR in October 2020.

Why did Avalara acquire TTR?

Avalara acquired TTR to provide even more helpful information to our customers by expanding our already robust tax content database with TTR’s comprehensive and accessible tax research library.

Who is Avalara Tax Research for?

Avalara Tax Research is helpful for everyone, but it’s especially ideal for finance and tax professionals, including tax directors, tax analysts, accountants, accounting directors, controllers, comptrollers, auditors, and more.

How is Avalara Tax Research priced?

Tax Research products use an annual subscription model. Speak with a sales representative for more details on pricing for your company.

Does Avalara Tax Research provide audit defense support?

Yes. Tax Research specialists will work with you to find the information you need to handle audits with ease. Avalara Tax Research is used by state and local governments, and we get real-time feedback regarding our tax answers.

As a self-service tool, does this mean I’m on my own after I sign up?

No. Avalara is proud to offer best-in-class support to help ensure you get the most from your tax research solution.

Does Avalara Tax Research integrate into my other Avalara products?

No. Avalara Tax Research is a stand-alone, web-based self-service research tool.

I don’t see an answer to my sales tax question. Can I ask my own?

Yes. If you subscribe to Avalara Tax Research Standard or Tax Research Premium, our Contact Tax Expert feature lets you send a question to our research team and promptly receive an answer.

How do I sign up for Tax Research?

Reach out to a sales representative today to sign up and get started on getting tax right through better research.

“TTR is quick to respond on providing any necessary guidance whether it be helping me find specific answers or helping with a topic that I can’t seem to find any information on.”

—Tax Professional, Automotive

“They have made complex research tasks a breeze, and at an affordable price. Every tax determination is cited and supported by the statutes, regs, rulings, and litigation that might apply.”

—Tax Manager, Banking and Finance

“I’ll be returning to my customer with confidence that the answer I am providing is correct and can be substantiated with the proper documentation needed.”

—Tax Manager, Technology

Explore other products to help you get tax compliance right

Discover innovative, cloud-based sales tax calculation products for a wide variety of industries and tax types.

Find licensing and registration solutions for businesses of all sizes and start collecting sales tax in new states.

Create a better purchase experience and reduce headaches for customers, vendors, and your business with exemption certificate management solutions.